Best AI Tools for Accounting | Top 10 AI Tools of 2025

Discover the top AI accounting tools of 2025 designed to streamline bookkeeping, automate invoicing, and enhance financial reporting—ideal for businesses aiming to boost efficiency and accuracy.

Introduction to AI Tools for Accounting

Accounting can be tough. It involves numbers, invoices, and reports. AI tools make it easier. They automate tasks, reduce errors, and save time. These tools help small businesses, freelancers, and big companies. This blog post lists the top 10 AI tools for accounting in 2025. We use simple words for easy understanding.

AI tools for accounting are growing fast. The market is expected to reach £5.21 billion in 2025 and grow to £29.33 billion by 2030. They handle tasks like bookkeeping, invoicing, and tax preparation. Whether you’re new to accounting or a pro, these tools can help. We cover features, pricing, and alternatives to help you choose.

In this post, we cover:

- Why AI tools help accountants

- Top 10 AI tools for accounting

- Pricing and features

- Alternatives to consider

- FAQs for beginners

Let’s begin!

Why Use AI Tools for Accounting?

AI tools make accounting simple. They automate boring tasks like data entry. They also identify errors and provide valuable insights. This helps you focus on important work, like planning or advising clients. Here’s why AI tools are great:

- Save Time: AI automates tasks like invoicing and bank reconciliation. This cuts hours of work.

- Reduce Errors: AI checks data for mistakes. It ensures accurate reports.

- Real-Time Insights: AI tools show financial trends instantly. This helps with decisions.

- Affordable: Many tools have free plans. Paid plans are often cheaper than hiring staff.

- Easy to Use: Most tools have simple dashboards. Beginners can use them easily.

AI doesn’t replace accountants. It helps them work smarter. For example, AI can process invoices in minutes. You can then focus on strategy or client meetings. These tools work with software like QuickBooks or Xero for smooth workflows.

Top AI Tools for Accounting

Here are five of the best AI tools for accounting. Each is easy to use and powerful. We explain their features, pros, cons, and pricing.

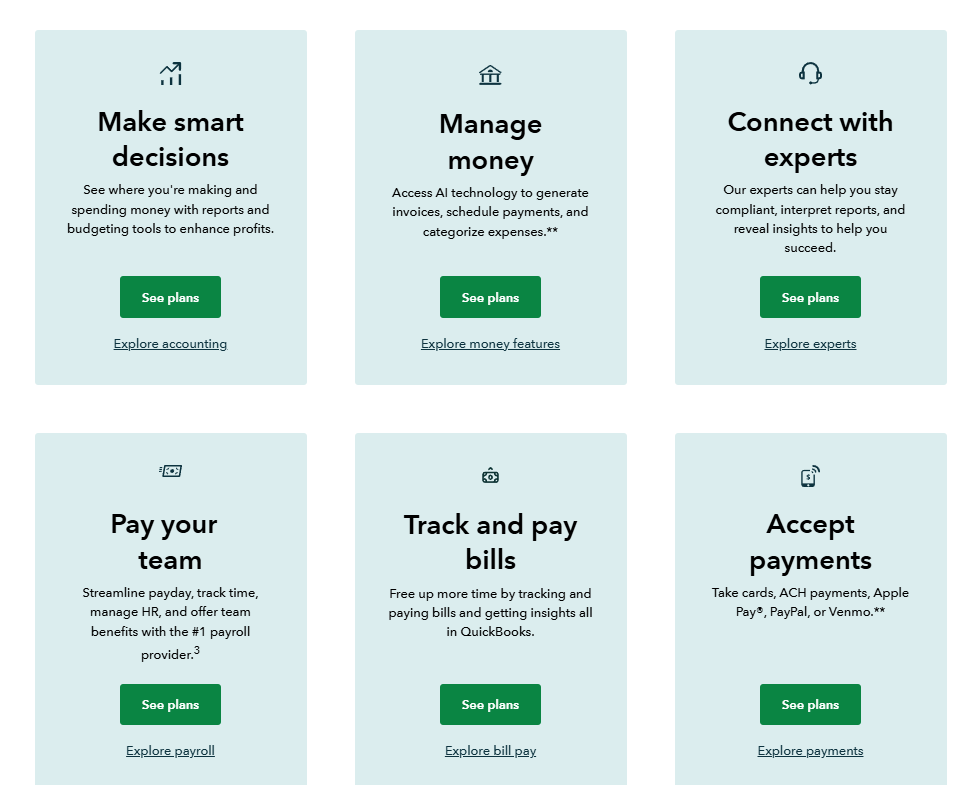

1. QuickBooks Online

QuickBooks is a top accounting tool. It uses AI to automate tasks. It’s great for small and medium businesses. QuickBooks is trusted by millions worldwide.

Features

- Intuit Assist: AI assistant for invoices, transaction categorization, and financial insights.

- Automated Reconciliation: Matches bank transactions automatically.

- Invoicing: Creates and tracks custom invoices.

- Reports: Shows real-time profit, loss, and cash flow.

- Integrations: Works with over 750 apps, like payroll tools.

Pros

- Easy for beginners.

- Reliable AI for automation.

- Free trial available.

- Scalable for growing businesses.

Cons

- Expensive for small budgets.

- Limited features in cheaper plans.

- Learning curve for advanced tools.

Pricing

- Simple Start: $30/month for basic features.

- Plus: $85/month for advanced tools.

- Advanced: $200/month for enterprise features.

Why Choose QuickBooks?

QuickBooks is best for small businesses needing automation. It’s reliable and integrates well.

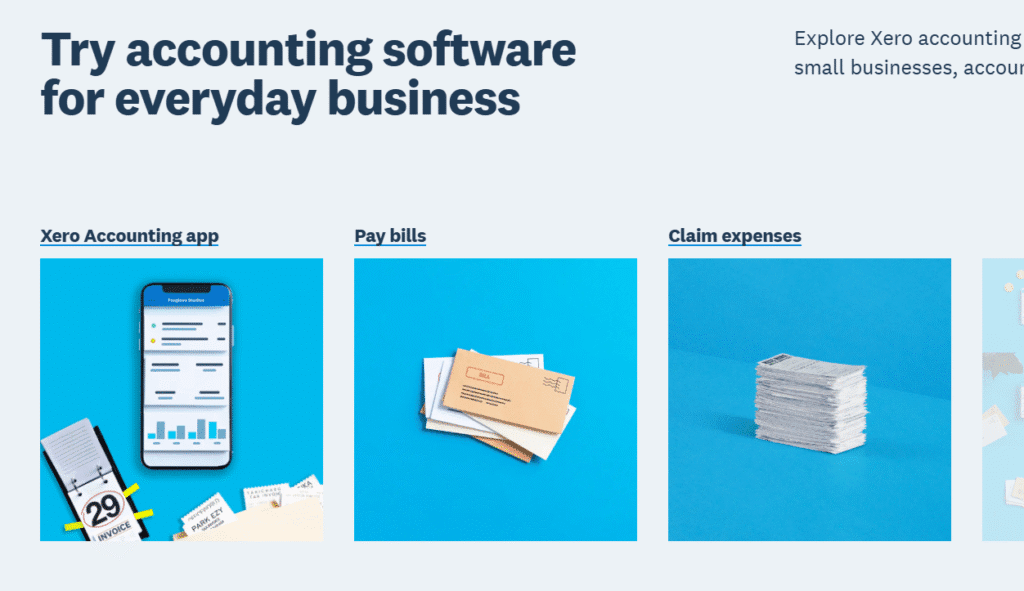

2. Xero

Xero is a cloud-based accounting tool. It’s great for small businesses and freelancers. Its AI features simplify bookkeeping and reporting.

Features

- AI Categorization: Automatically sorts transactions.

- Invoicing: Sends custom invoices and payment reminders.

- Bank Feeds: Connects to banks for real-time updates.

- Reports: Shows financial trends and forecasts.

- Mobile App: Manage finances on the go.

Pros

- User-friendly interface.

- Affordable plans.

- Great for small teams.

- Strong integrations.

Cons

- Limited reporting in basic plans.

- No phone support.

- Less AI than competitors.

Pricing

- Early: $3.75/month for basic invoicing.

- Growing: $10.50/month for core features.

- Established: $19.50/month for full features.

Why Choose Xero?

Xero is affordable and easy. It’s perfect for freelancers and small businesses.

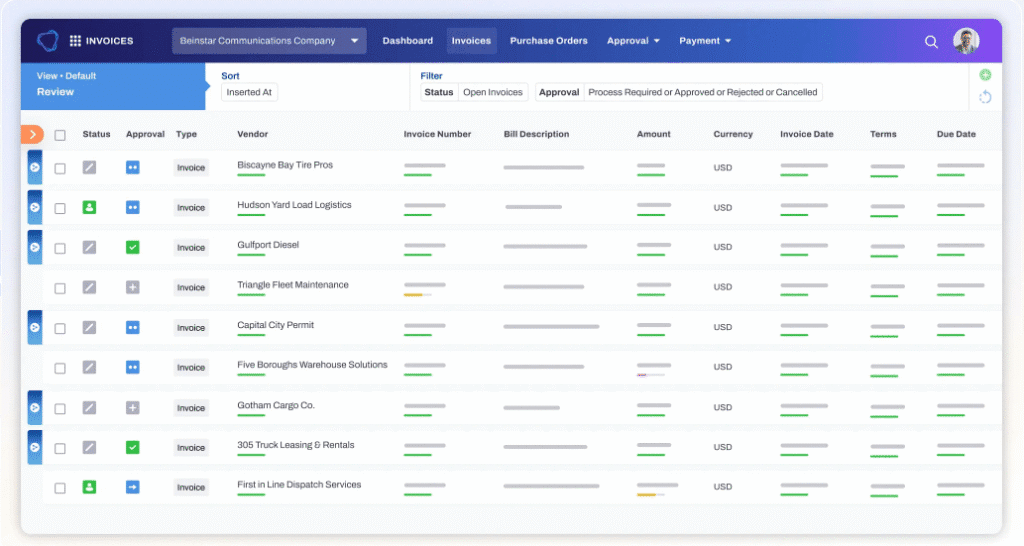

3. Vic.ai

Vic.ai focuses on accounts payable. It uses AI to process invoices and payments. It’s great for businesses with high invoice volumes.

Features

- Invoice Processing: Extracts data from invoices automatically.

- AI Approvals: Routes invoices to the right approvers.

- Integrations: Works with QuickBooks, Xero, and Sage.

- Analytics: Shows spending trends.

- Payment Processing: Handles payments via card or ACH.

Pros

- Saves time on invoices.

- High accuracy (99%).

- Works with major software.

- Great for large teams.

Cons

- No public pricing.

- Limited to accounts payable.

- Setup may need support.

Pricing

- Custom pricing based on business size. Contact Vic.ai for a quote.

Why Choose Vic.ai?

Vic.ai is best for automating invoices. It suits businesses with complex workflows.

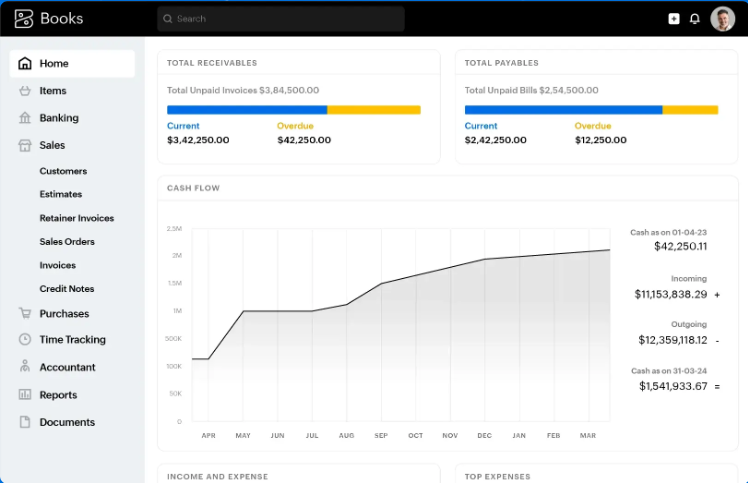

4. Zoho Books

Zoho Books is affordable and user-friendly. It’s part of the Zoho suite. It uses AI for small businesses and freelancers.

Features

- AI Categorization: Sorts transactions automatically.

- Invoicing: Creates professional invoices.

- Expense Tracking: Scans receipts with AI.

- Client Portal: Shares data with clients.

- Integrations: Works with other Zoho apps.

Pros

- Budget-friendly.

- Easy to use.

- Great for small teams.

- Free plan available.

Cons

- Limited AI features.

- Smaller database than QuickBooks.

- Slow customer support.

Pricing

- Free Plan: For businesses with revenue under $50,000.

- Standard: $20/month for core features.

- Professional: $50/month for advanced tools.

Why Choose Zoho Books?

Zoho Books is great for small budgets. It’s simple and effective.

5. FreshBooks

FreshBooks is designed for freelancers and small businesses. It uses AI for invoicing and time tracking. It’s easy to use and affordable.

Features

- AI Invoicing: Creates and tracks invoices.

- Expense Tracking: Scans receipts and categorizes expenses.

- Time Tracking: Tracks billable hours.

- Reports: Shows simple financial dashboards.

- Mobile App: Manage tasks anywhere.

Pros

- Beginner-friendly.

- Great for service businesses.

- Affordable plans.

- Free trial available.

Cons

- Limited features for large businesses.

- Less AI than competitors.

- No inventory management.

Pricing

- Lite: $19/month for basic features.

- Plus: $33/month for more clients.

- Premium: $60/month for advanced tools.

Why Choose FreshBooks?

FreshBooks is best for freelancers needing simple invoicing.

More AI Tools for Accounting

6. Dext Prepare

Dext Prepare automates data extraction. It pulls information from receipts and invoices. It’s great for accountants handling lots of documents.

Features

- Data Extraction: 99% accurate document processing.

- Integrations: Works with QuickBooks, Xero, and 11,500+ banks.

- Automation: Transfers data to accounting software.

- Analytics: Tracks expenses and trends.

- Mobile App: Upload receipts on the go.

Pros

- Saves time on data entry.

- High accuracy.

- Easy integrations.

- Good customer reviews (4.6/5 on G2).

Cons

- Expensive for small teams.

- Limited customer support.

- Complex setup for beginners.

Pricing

- Essentials: $199.99/month for 10 clients.

- Advanced: $214.99/month for more features.

- Custom: Contact Dext for pricing.

Why Choose Dext Prepare?

Dext is best for document-heavy workflows. It’s great for accountants.

7. Botkeeper

Botkeeper automates bookkeeping. It uses AI to categorize transactions and create reports. It’s ideal for accounting firms.

Features

- Bookkeeping Automation: Handles data entry and reconciliation.

- Reports: Generates real-time financial reports.

- Client Portal: Shares data with clients.

- Integrations: Works with QuickBooks and Xero.

- Tax Support: Helps with tax preparation.

Pros

- Saves time on bookkeeping.

- Great for firms.

- Real-time insights.

- Scalable for growth.

Cons

- Custom pricing only.

- Not for solo freelancers.

- Steep learning curve.

Pricing

- Custom pricing. Contact Botkeeper for a quote.

Why Choose Botkeeper?

Botkeeper suits accounting firms needing automation.

8. Stampli

Stampli focuses on accounts payable. Its AI, Billy the Bot, automates invoice processing. It’s great for finance teams.

Features

- AI Copilot: Learns approval rules and codes invoices.

- Invoice Capture: Extracts data automatically.

- Communication: In-platform messaging for teams.

- PO Matching: Matches invoices to purchase orders.

- Integrations: Works with NetSuite and QuickBooks.

Pros

- Fast invoice processing.

- Easy to use.

- Great for teams.

- High accuracy.

Cons

- Limited to accounts payable.

- Custom pricing.

- Setup needs support.

Pricing

- Custom pricing. Contact Stampli for a quote.

Why Choose Stampli?

Stampli is best for invoice automation. It suits mid-sized businesses.

9. Trullion

Trullion automates complex accounting tasks. It focuses on lease accounting and revenue recognition. It’s great for compliance.

Features

- AI Audits: Automates lease and revenue workflows.

- Compliance: Supports ASC 842 and IFRS 16.

- Data Extraction: Pulls data from contracts.

- Reports: Generates compliance-ready reports.

- Integrations: Works with ERP systems.

Pros

- Great for compliance.

- Saves time on audits.

- High accuracy.

- Scalable for enterprises.

Cons

- Expensive for small businesses.

- Limited to specific tasks.

- Custom pricing.

Pricing

- Starts at $3,000/year. Contact Trullion for a quote.

Why Choose Trullion?

Trullion is best for lease accounting and compliance.

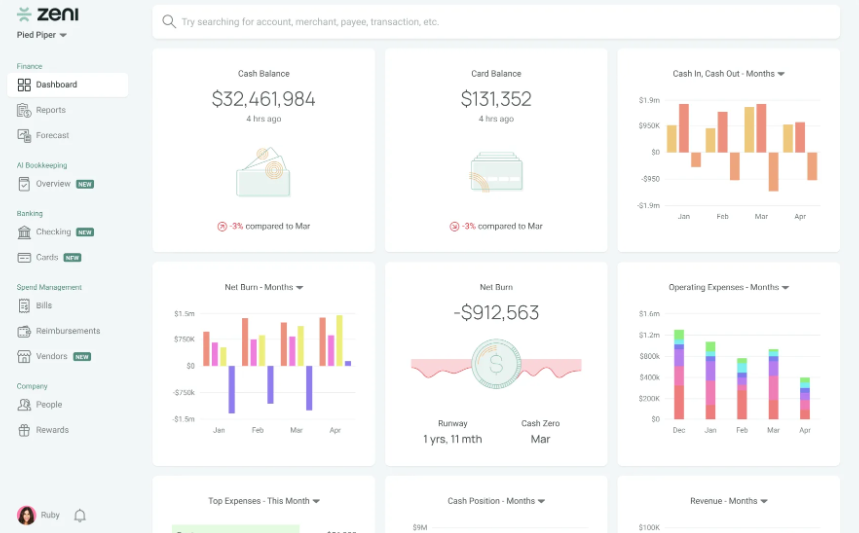

10. Zeni

Zeni combines AI and human expertise. It automates bookkeeping and provides insights. It’s great for startups and small businesses.

Features

- AI Bookkeeping: Automates data entry and reconciliation.

- Real-Time Insights: Shows financial trends.

- Expense Tracking: Manages receipts and expenses.

- Reports: Creates monthly and yearly reports.

- Human Support: Offers expert advice.

Pros

- Combines AI and human help.

- Affordable for startups.

- Real-time data.

- Easy to use.

Cons

- Custom pricing only.

- Limited advanced features.

- Not for large enterprises.

Pricing

- Custom pricing. Contact Zeni for a quote.

Why Choose Zeni?

Zeni is great for startups needing AI and human support.

Conclusion and FAQs

Conclusion

AI tools for accounting are game-changers. They save time, reduce errors, and provide insights. QuickBooks, Xero, and Vic.ai lead for small businesses and invoice automation. Zoho Books and FreshBooks are affordable for freelancers. Dext Prepare and Botkeeper excel in data extraction and bookkeeping. Stampli and Trullion are great for accounts payable and compliance. Zeni offers a unique AI-human mix for startups.

Each tool fits different needs. Test free trials to find the best one. QuickBooks and Xero are great for beginners. Vic.ai and Stampli suit complex workflows. Visit QuickBooks or Xero to start. In 2025, AI tools will help accountants work smarter, not harder. For more AI tools, check our site.

FAQs

1. What are AI accounting tools?

AI accounting tools automate tasks like bookkeeping, invoicing, and reporting. They use AI to reduce errors and save time.

2. Are AI tools good for beginners?

Yes, tools like QuickBooks and FreshBooks are easy to use. They have simple dashboards and tutorials.

3. Can AI tools replace accountants?

No, AI automates tasks but needs human judgment for decisions and client advice.

4. Are there free AI accounting tools?

Yes, Zoho Books and Xero offer free plans with limits. QuickBooks and FreshBooks have free trials.

5. Which tool is best for small businesses?

QuickBooks and Xero are great for small businesses. They’re easy and scalable.

6. Which tool is best for freelancers?

FreshBooks and Zoho Books are affordable and simple for freelancers.

7. How much do AI accounting tools cost?

Prices range from $0 (free plans) to $200+/month. Some, like Vic.ai, have custom pricing.

8. Can AI tools help with taxes?

Yes, tools like Botkeeper and Trullion help with tax preparation and compliance.

9. Do AI tools integrate with other software?

Yes, most tools work with QuickBooks, Xero, or NetSuite for smooth workflows.

10. How do I choose the right tool?

Test free trials. Consider your budget, business size, and needs like invoicing or compliance.

For more accounting tips, check AccountingWEB. Start automating your finances today!